We are the financial services BPO specialists

Achieve compliant operations, build customer loyalty and lower costs by partnering with us. Only we deliver all three.

Upholding your trusted image is vital, but rigorous compliance often comes at the cost of customer satisfaction.

Matching the digital innovation and experiences of disruptive startups. Maintaining data privacy and managing risk. Meeting KPIs while keeping costs low. We make your most pressing to-dos doable.

We help financial services companies

Manage risk at

every touchpoint

Keep pace with rapidly-evolving cyber threats

Meet customers rising expectations

Drive continuous improvement in cost & performance

Our signature banking and financial services offerings

Card services

- Account inquiries and maintenance

- Card replacement

- Customer service

- Disputes and escalations

- New accounts

- Risk and fraud management

- Payment processing

- Technical support

Retail banking

- Account inquiries and maintenance

- Card replacement

- Customer service

- Disputes and escalations

- New accounts

- Risk and fraud management

- Payment processing

- Technical support

Lending & financing

- Account inquiries and maintenance

- Back office

- Customer service

- Early-stage collections

- Payment processing

- Underwriting

Payments & fintech

- Collections

- Customer service

- Fraud services

- Technical support

- Verification and compliance

- Mobile banking support

Compliance is woven into the very fabric of what we do

We take a rigorous approach to tightly integrating risk management across technologies, business processes and corporate culture.

Operate in full regulatory compliance from day one of the contact center rollout

We align our solutions to your contracts, integrate controls to adapt to shifting regulations and provide transparent audits and training for continued script adherence and overall conformance.

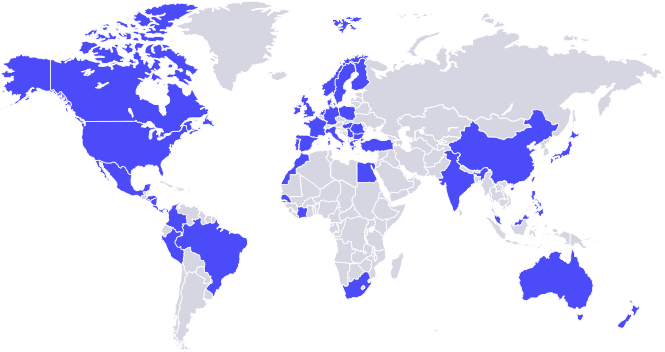

Global oversight ensures adherence across all operations, everywhere

Our independent and dedicated global compliance teams oversee adherence to relevant domestic and international laws and regulations across all business processes and delivery locations.

Drive continuous alignment with our proven multi-pronged approach

We advise on updating controls and processes to address new laws and regulations, assist with training and process reviews to facilitate adherence and maintain a detailed inventory of applicable laws and licenses to ensure conformance across operations.

Top security certifications and industry compliance standards

PCI DSS

ISO 27001:2013 and ISO 27002:2013

SOC Type 1 and

SOC Type 2

Get an inside look at how we empower financial leaders with compliance, efficiency and risk management solutions, all while driving customer satisfaction.

Client success story

Credit card giant turned top US bank slashed audit time by over 90%

When one of the top three most trusted US banks was struggling with inefficient auditing processes and compliance gaps, it tapped into our extensive capabilities around audit readiness and regulatory diligence.

We embedded audit readiness organization-wide by elevating compliance leaders and co-creating a best practices playbook. This integrated risk/loss prevention into everyday workflows, ensuring all employees were always prepared for audits. With us, the client was able to:

- Reduce audit durations from two days down to a half day or less

- Foster an audit-ready compliance culture company-wide

- Gain recognition from third-party auditors for efficient, consistent inspections

Rock-solid security sets the stage for our intelligent analytics capabilities

Guided by a security-focused philosophy, we engineer solutions and tools to safeguard data and maintain compliance while relying on robust protocols to respond quickly to threats. Our #1 ranking for security standards among BPOs is driven by our expert workforce, advanced certifications, integrated CX technologies and customized audits for each client.

Protect your business and your customers from online fraud with:

- Certified security protocols and technology

- Dedicated teams specializing in data privacy

- Rigorous policies for remote access and work from home

- Physical and environmental controls for facilities

- Custom security provisions to meet client requirements

With our layered security approach, you can ensure stringent data privacy and achieve full compliance with regulations like GDPR. We enable robust fraud prevention while securing customer information end-to-end.

Client success story

Top-tier national retail bank outsmarts fraudsters with custom interaction analytics

While performing an analysis for a bank with +100M clients, our experts uncovered a pressing challenge: their sensitive customer data was growing exponentially, yet they lacked actionable insights to combat fraud patterns.

We implemented highly secure, custom reporting solutions aligned to the firm’s data infrastructure and requirements, unlocking mission-critical visibility through targeted analytics. With our experts and customizable tech, the client is now able to:

- Quickly pinpoint potential fraud using established processes and smart analytics

- Gain granular visibility into fraud patterns, enabling more targeted detection

- Keep promises to customers about safeguarding data privacy and security

We secure every step of the financial experience with our industry-leading experts

With +35K associates, we provide more than typical call center staffing. Our team members are proactive problem-solvers who ask thoughtful questions to uncover root causes of process issues and customer challenges. We’ve developed the deep expertise and tools to innovate and meet consumer demands while managing risk and ensuring ongoing compliance.

We enable the security and compliance crucial to your business

The Foundever Security team is continually improving its skills to stay up to date on the latest technology. The below certifications are just a few of the many certifications held by our team of highly competent security professionals.

Client success story

5-agent pilot becomes 20-year partnership with the nation's largest all-digital bank

When one of the top 10 most trusted US banks first contracted with us over two decades ago, it was for a small pilot program staffed by just five customer care agents. After seeing our expertise in action, the initial engagement progressed into an extensive, multifaceted relationship.

Today, we handle inbound and outbound communications – voice, emails, secure messaging and chat – throughout the entire customer journey, and across all lines of business LOBs, from origination and onboarding to servicing and collections.

Our hands-on collaborative approach and unwavering commitment to continuous improvement fuel our partnership to this day, enabling the client to:

- Deliver exceptional end-to-end customer experiences across all business lines

- Create exceptional customer experiences from loan origination to collections

- Seamlessly adapt and stay relevant in a disruption-prone industry

Our universal operations standards empower consistent service delivery and guarantee we provide uncompromising excellence, no matter the geography, industry or account size.

PeakOS framework

We’ve mastered the formula for delivering reliable, quality service while optimizing costs and resources. It ensures you have consistent systems in place for managing disruptions, avoiding risks and driving maximum operational efficiency.

CX Everywhere

Our hybrid model combines work-from-home agents and support hubs to give financial services organizations access to a flexible global network of highly-trained customer service professionals for adaptable, resilient operations.

Advanced tech

By integrating leading CCaaS and WFM platforms with real-time interaction analytics and conversational AI, we enable complete policy oversight to provide customer-focused service fully aligned with all regulatory rules and protocols.

Client success story

Custom continuous improvement model drives dramatic gains for a Big Four bank

When this Fortune 100 company struggled to hit key performance metrics, they chose us as an operational partner based on our expertise in boosting team performance and improving efficiencies.

We collaborated closely with them to deeply understand their goals, pain points processes and training gaps. This enabled us to develop a custom continuous improvement integration model that led to tremendous improvements, outperforming five other vendors and the in-house team. It included:

- Lean Six Sigma practices fully integrated into coaching, audits, skills enhancement and training certification

- Robust agent training focused on targeted skills development and performance benchmarking

- Ongoing performance analysis to identify successes for scaling and opportunities for improvement

- Real-time coaching to reinforce best practices and address outlier behaviors